Rumored Buzz on Custom Private Equity Asset Managers

Wiki Article

Custom Private Equity Asset Managers Can Be Fun For Everyone

(PE): investing in business that are not publicly traded. Roughly $11 (https://worldcosplay.net/member/1673310). There might be a couple of points you do not understand regarding the sector.

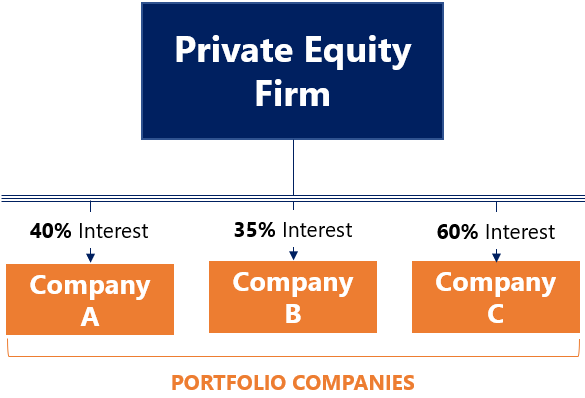

Partners at PE firms raise funds and manage the money to generate positive returns for investors, usually with an financial investment perspective of in between four and 7 years. Private equity firms have a variety of investment choices. Some are stringent sponsors or passive financiers completely depending on management to grow the business and generate returns.

Because the very best gravitate towards the larger deals, the middle market is a considerably underserved market. There are extra vendors than there are very experienced and well-positioned finance professionals with extensive buyer networks and sources to take care of an offer. The returns of private equity are typically seen after a couple of years.

The Single Strategy To Use For Custom Private Equity Asset Managers

Traveling below the radar of huge multinational firms, a lot of these tiny business usually provide higher-quality customer support and/or specific niche items and solutions that are not being used by the large corporations (https://anotepad.com/note/read/gtek6cnk). Such advantages bring in the rate of interest of private equity companies, as they have the understandings and savvy to exploit such chances and take the business to the next level

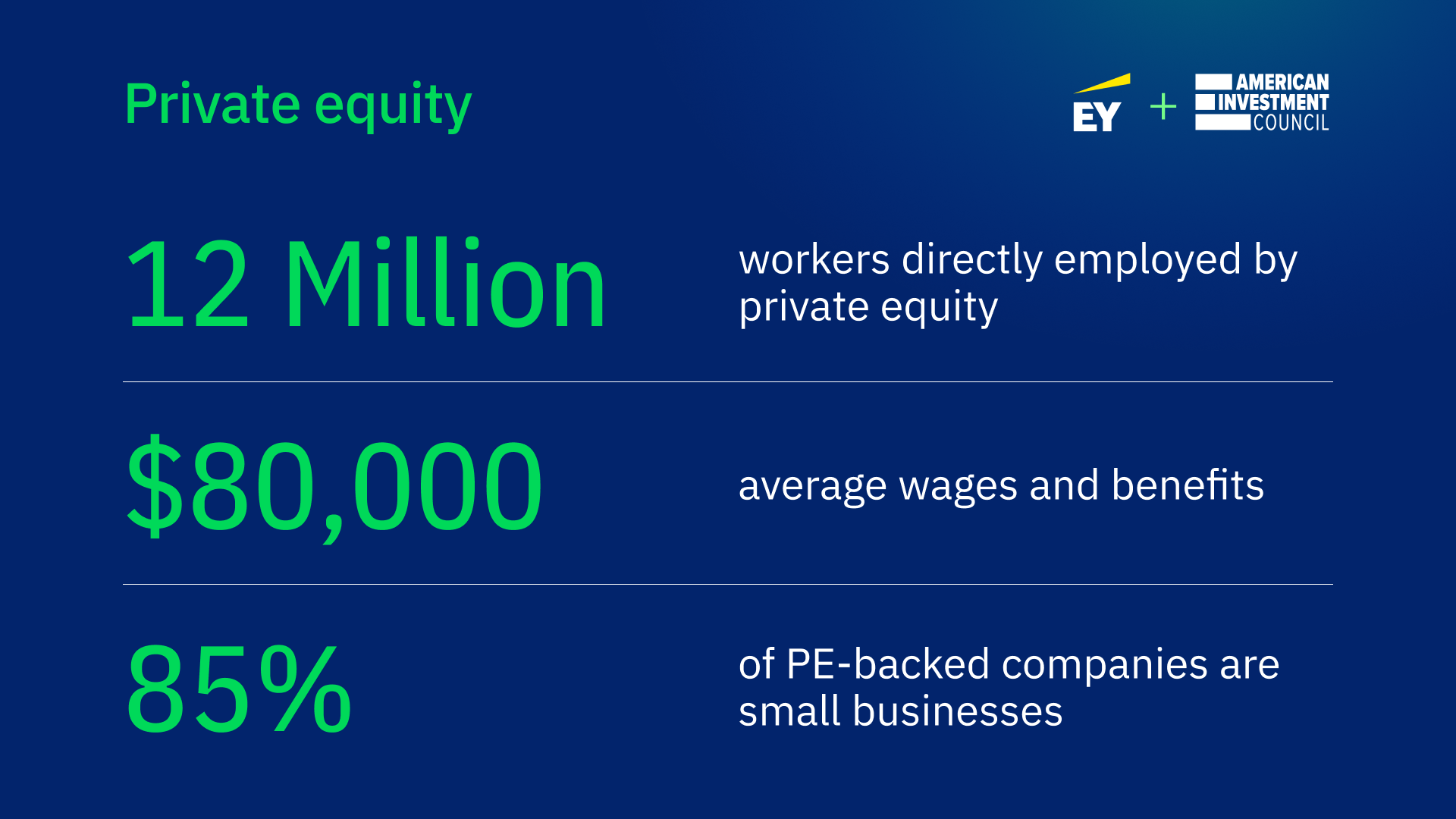

The majority of managers at profile business are provided equity and benefit payment frameworks that award them for striking their economic targets. Private equity chances are commonly out of reach for people who can't spend millions of bucks, but they should not be.

There are guidelines, such as limits on the aggregate quantity of money and on the variety of non-accredited capitalists. The personal equity organization attracts a few of the ideal and brightest in company America, consisting of top entertainers from Fortune 500 business and elite administration consulting firms. Law practice can also be hiring premises for exclusive equity click hires, as audit and lawful abilities are required to total bargains, and transactions are very sought after. https://www.imdb.com/user/ur173700848/?ref_=nv_usr_prof_2.

What Does Custom Private Equity Asset Managers Mean?

Another drawback is the absence of liquidity; when in an exclusive equity purchase, it is challenging to leave or sell. There is a lack of adaptability. Personal equity likewise comes with high costs. With funds under administration already in the trillions, personal equity companies have become eye-catching financial investment cars for rich individuals and establishments.

For years, the attributes of private equity have actually made the asset course an eye-catching proposal for those that could take part. Currently that accessibility to private equity is opening as much as even more specific investors, the untapped capacity is coming to be a truth. The concern to consider is: why should you invest? We'll begin with the main disagreements for purchasing private equity: Just how and why personal equity returns have traditionally been more than various other possessions on a variety of degrees, Just how consisting of personal equity in a profile affects the risk-return account, by assisting to branch out versus market and cyclical threat, Then, we will describe some crucial factors to consider and threats for personal equity investors.

When it involves presenting a new possession into a portfolio, the most basic consideration is the risk-return account of that possession. Historically, personal equity has exhibited returns comparable to that of Emerging Market Equities and greater than all various other typical asset classes. Its relatively low volatility paired with its high returns produces an engaging risk-return account.

Facts About Custom Private Equity Asset Managers Uncovered

In fact, personal equity fund quartiles have the widest variety of returns across all different possession classes - as you can see listed below. Method: Internal price of return (IRR) spreads determined for funds within classic years separately and after that balanced out. Average IRR was computed bytaking the average of the average IRR for funds within each vintage year.

The takeaway is that fund selection is vital. At Moonfare, we perform a strict option and due diligence process for all funds noted on the system. The result of adding personal equity into a profile is - as constantly - based on the portfolio itself. A Pantheon research study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the best private equity firms have access to an also bigger swimming pool of unidentified opportunities that do not deal with the same scrutiny, in addition to the sources to perform due diligence on them and determine which deserve purchasing (Asset Management Group in Texas). Investing at the first stage means greater threat, however, for the companies that do succeed, the fund take advantage of greater returns

Getting My Custom Private Equity Asset Managers To Work

Both public and personal equity fund supervisors commit to investing a portion of the fund however there stays a well-trodden concern with aligning interests for public equity fund administration: the 'principal-agent trouble'. When an investor (the 'principal') hires a public fund supervisor to take control of their funding (as an 'representative') they pass on control to the supervisor while retaining ownership of the possessions.

In the situation of private equity, the General Companion doesn't simply make an administration charge. Private equity funds additionally reduce one more form of principal-agent trouble.

A public equity financier inevitably desires one thing - for the management to raise the supply rate and/or pay out dividends. The financier has little to no control over the decision. We showed over exactly how several private equity techniques - particularly bulk acquistions - take control of the running of the business, making sure that the long-lasting value of the business precedes, pushing up the roi over the life of the fund.

Report this wiki page